Completing the Accommodation Details (AC) screen and assessing Rent Assistance (RA) 108-18092646

Reading the Assessment Results (AR) screen and locating information about system calculations

Table 1

|

Item |

Description |

|

$ Adj Amt field |

|

|

Rate Details (RATS) |

Two tables will display within the AR screen: Daily Rate Summary (RATS) The old and new rates of payment will be displayed in the table. Select the pay periods by using the radio buttons on the left. Yellow selection boxes will display under the table. These selection boxes can be used for further information about the entitlement for the relevant pay period. The names and number of yellow selection boxes depend on the system which delivers the RA. If RA is received with an income support payment, 2 options will display:

If RA is received with Family Tax Benefit (FTB), 5 options will display:

Note: changes for FTB payments apportion over a financial year therefore the adjustment dates may not match. The REX will have further information. Daily Rate Component (RAC) This table will explain the amount in the $ Adj Amt field. To display more details for each of the lines in the table, select the radio button on the left. More details will display in a new table at the bottom of the screen. Note: changes for FTB payments apportion over a financial year therefore the adjustment dates may not match. |

|

Rate Summary (!RATS) |

Provides the information in web format. Select links to open information. |

|

The DOER screen will display with the applicable dates, entitlement and rule numbers applied within the activity. |

Hints and tips - assessing the outcome of the Accommodation Details (AC) screen update

Table 2

|

Item |

Description |

|

Rent Assistance (RA) has stopped even though verification coding is correct |

Check for a Not Verified - NVE verification line on the Accommodation History (ACS) screen. Example:

If this line, or any earlier Not Verified - NVE line is incorrect, delete the line. |

|

Unexplained gap in a period of arrears |

Other possible causes are gaps in entitlement or payability, such as:

|

|

Family Tax Benefit (FTB) RA rate has changed but rent amount paid hasn't |

For more information, see What to check when Family Tax Benefit (FTB) rate has changed |

System issue KE10772 impacting some stimulus customers

Table 3

|

Item |

Description |

|

1 |

Due to system issue (KE10772) stimulus customers may be overpaid RA if they don't notify of a rent increase or the commencement of paying rent in the reporting period for the date of the change. Stimulus customers who don't notify of a rent increase or rent commencement, in the reporting period for the change, are only entitled to a higher rate of Rent Assistance (RA) or payment of RA from the date of notification. This system issue causes the system to apply a NOHL Rule of 99 or 10 which either pays an increased or new rate of RA from an earlier date such as the entitlement period start date, a CPI date, the date of restoration or a reassessment date. Rule 10: Will cause the system to apply the new rate of RA from the entitlement period start date (EPSD). Rule 99: Will cause the system to apply the new rate of RA from either a CPI date, or the date of restoration or a reassessment date in the activity (that is, if BA screen is coded). |

|

2 |

Check if arrears are incorrect due to NOHL Rule 99 or 10 Check the NOHL rules when the activity is taken to AR by selecting 'NOHL Rule Explanation (DOER)' in the left hand menu in Customer First. The DOER screen will then display with the applicable dates, entitlement and rule numbers applied within the activity. If the following rules are present and the arrears do not commence from the correct date as detailed in table 4 above, the customer record will require an override. |

|

3 |

Incorrect NOHL Period example – Rule 10: The customer was receiving $110.62 a fortnight in RA. Customer had an increase to their rent on 17 March 2020 and did not notify this change in their report for EPED 25 March 2020. The customer notified the rent increase on 8 April 2020.

In this example, NOHL rule 10 was applied incorrectly increasing RA from the entitlement period start date and not the date of notification. To correct this RCO must be coded with the following:

RCO is coded to ensure the RA increased rate is correctly paid from the date of notification (8 April 2020) onwards. |

|

4 |

Incorrect NOHL Period example – Rule 99: The customer was previously receiving a zero rate of RA and commenced paying rent from 10 September 2020. The customer notified the Agency on 26 September 2020 regarding their rental liability.

In this example, NOHL rule 99 was applied incorrectly increasing RA from the CPI date and not the date of notification. To correct this RCO must be coded with the following:

RCO is coded to ensure RA is only paid from the date of notification (26 September 2020) onwards. |

Date of effect for Rent Assistance (RA) arrears for a notification reporter

See Rent Assistance (RA) > D > DOE for RA - notification reporter.

Table 4: examples of understanding correct date of effect to pay Rent Assistance (RA) arrears for a notification reporter

|

Item |

Description |

|

1 |

A notification reporter receives RA at a rate lower than the maximum rate payable On 2 February customer's rent increases but they do not notify until 13 February. The customer's rate of payment is increased from 13 February, the date of notification.

|

|

2 |

A notification reporter receives RA at a lower rate than the maximum rate payable On 2 February customer advises of a change to their rent. The new rent amount is notified as $200 per week but is recorded as $200 per fortnight. On 18 February, customer queries the rate of RA and during the discussion it emerges that they are paying $200 per week. In this situation the contact on 18 February would be considered a request for review. The customer's rate of payment can be increased from 2 February. |

|

3 |

A notification reporter receives RA and is sent a rent certificate but does not return it within 28 days The customer's RA is cancelled from 4 February. On 5 March, the customer lodges the rent certificate. In this situation, the lodgement of the rent certificate on 5 March is considered a request for review. Arrears may be payable from 4 February. |

Date of effect for Rent Assistance (RA) - stimulus customer

See Rent Assistance (RA) > D > DOE for RA - stimulus customer

Table 5: understanding correct date of effect to pay Rent Assistance (RA) arrears for a stimulus customer.

|

Item |

Description |

|

1 |

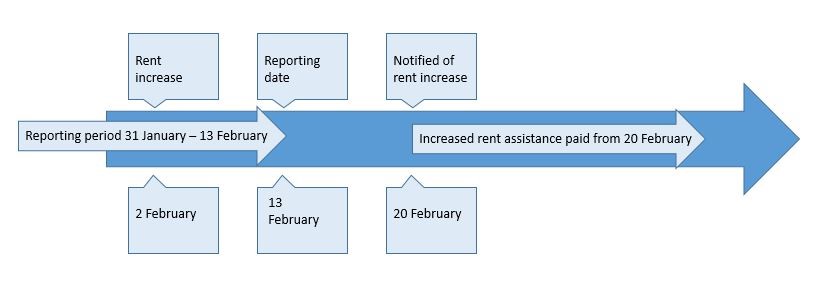

A stimulus customer receives RA, has an increase in rent but does not notify of increase in reporting period Customer's rent increased on 2 February in the reporting period covering 31 January to 13 February. Customer does not advise of the increase when they lodge their report on 13 February. Customer notifies increase on 20 February. Increase in RA would take effect from 20 February (date of notification).

|

|

2 |

A stimulus customer receiving RA has an increase in rent, advises of the increase when they report, but does not provide verification within 28 days On 13 May, customer's rent increased. Customer advised of increase when they report for the 10 May to 23 May on the due date (23 May). Customer is paid RA increase during period 13 May (Chg Address/Accom Circs-14 days to verify - COA verification) until 10 June (Not Verified - NVE verification). Customer provides a Rent Certificate (SU523HD) verifying rent details on 10 July. As customer met original notification requirements for increase in rent and verification provided within 13 weeks, customer is entitled to RA arrears from the date RA was paid to (10 June). |

|

3 |

A stimulus customer not receiving RA commences paying rent and advises when they report, but reports after the due date On 1 June, customer commenced paying board and lodgings. Customer was due to report their circumstances on 13 June (for period 31 May to 13 June) but this was not advised until 16 June. Even though the customer’s report was late, customer fulfilled notification requirements and RA would commence from the date of event (1 June). |

|

4 |

A stimulus customer receiving RA has a rent increase, however, advises increase on a report for a later period Customer has an increase in rent on 5 May. This increase is advised on 31 May with their report for period 18 May to 31 May. Increase in RA would be payable from date of notification, 31 May. |

Date of effect for RA - Family Tax Benefit (FTB) customer

See Rent Assistance (RA) > D > DOE for RA - FTB customer

Table 6: understanding correct date of effect to pay RA arrears for an FTB customer

|

Item |

Description |

|

1 |

A customer who will receive RA with their FTB, verifies an increase in rent that occurred some time ago Customers rent increased to $300 per week on 20 August 2018. The customer verifies this change on 20 June 2020. RA can be paid, based on $300 rent per week, from the date of event which is 20 August 2018. |

|

2 |

A customer who will receive RA with their FTB, verifies that they started paying rent some time ago Customer who is not receiving rent assistance advises that they started paying rent of $250 per week 12 May 2018. They forgot to tell us about this change and only verify the change on 2 July 2020. RA can be paid, based on $250 per week, from the beginning of the financial year before the financial year in which the customer verified the change in circumstances. As the change was verified in the 2020/2021 financial year RA can be paid from the beginning of the financial year before, that is 01/07/2019. |

RA example date of event scenarios for new claims

Table 7

|

Scenarios |

Date of event |

|

Note: check information for the type of claim before deciding on the date of event for claims. A variety of different claim specific provisions can impact the date selected. Verification coding may need to be updated. In this table a reference to income support payment includes ABSTUDY. |

|

|

All customers |

|

|

Rent has been verified within the previous 12 months of their current claim and there is no change in accommodation circumstances since verification date. |

No coding required. If there is a New Claim-14 days to verify - NCL verification line on the Accommodation History (ACS) screen, delete it. |

|

Customer or partner Family Tax Benefit (FTB) current and entitled to Rent Assistance (RA) with FTB |

|

|

Rent previously verified. Verification was not within the previous 12 months of their current claim, and there has been no change in accommodation details since verification. |

The earliest of:

|

|

Rent previously verified. The customer has indicated they have had a change in accommodation circumstances. |

The later of:

|

|

Not FTB current and claiming an income support payment |

|

|

Customer is a transferee, the net rent amount has changed, and the person was receiving max rate RA with their previous payment. Note: while this rule has been approved, it will not be applied automatically at data load, as the online claim is unable to recognise a transferee. |

Date of change. |

|

All other accommodation circumstances. |

The earliest of:

|

|

Not FTB current or FTB current and not currently receiving RA |

|

|

Customer/partner is making a new FTB claim. |

Date of FTB eligibility where FTB claim is granted/rejected or Date of claim - where FTB is assessed (pre-birth claim). If the date of RA eligibility is later than, or changes after the date FTB is granted, a new AC screen for that date will be needed. For other FTB claim scenarios or complex claim cases refer to: |

|

Customer/partner is FTB/CUR and not currently in receipt of RA. |

Date of change. |

Date of receipt

Table 8

|

Item |

Description |

|

Date of receipt (DOR) change of circumstances |

DOR In relation to the notification of changed circumstances, is the date on which Services Australia became aware of the change of circumstances or notifiable event. For more information see Date of receipt. |

|

Date of receipt (DOR) rent verification document/s |

Where the customer has already notified of the change and has now provided the verification document, the DOR will be the date all documents needed to verify the rent have been provided. Where multiple documents have been provided over multiple dates, the DOR is the date the last of the required documentation was provided. For examples see resources in Processing proof of rent for the Verification field on the Accommodation Details (AC) screen. |

Date of receipt for online updates

Table 9

|

Item |

Description |

|

1 |

Date of receipt (DOR) for AC screen failed OLS or APP updates When a customer updates accommodation information via their Centrelink online account or Express plus mobile app the date of receipt (DOR) is the date the update was submitted through that service. When all of the following occurs, the DOR to be used to finalise a failed online/app update will depend on whether the outcome is favourable or unfavourable to the customer:

When a customer is providing new information on a different date, the effect the new information will have on their RA entitlement (favourable/no change/ unfavourable) must be determined in order to decide the most appropriate DOR. When the application of the new information will result in:

|

Postal address

Table 10

|

Item |

Description |

|

1 |

Add postal address In Customer First:

|